Frequently Asked Questions About Homeowners Insurance

Table of Contents

You need homeowners insurance for your new home.

You're about to purchase the home of your dreams. But before you can conclude everything with your mortgage lender, you need to make sure you have homeowner's insurance.

And before you settle on coverage, you need to make sure you're getting a homeowner's policy that protects your home fairly and at a reasonable rate.

Getting the right insurance coverage is all about posing the right questions. We're here to assist you to run through some of the critical inquiries you might ask yourself as you shop for a homeowner insurance policy. And then we'll give the answers you need to make an informed decision.

When you know what kind of policy you're looking for, you can compare quotes side by side and find the right insurance company. No more calling dozens of insurance companies and scribbling down quotes. With Moran Insurance, all the information you need is in one place since we have analyzed and assembled it.

Don't jump into a policy without asking yourself or others the following:

What does a Standard Homeowner's Insurance Policy Cover?

Most conventional homeowners' insurance policies include four main types of coverage:

- Dwelling Coverage: Covers your home's physical structure

- Liability Coverage: This covers costs associated with any bodily injury sustained by someone in your home

- Personal Property Coverage: Covers your belongings inside the home

- Additional Expenses Coverage: This includes any extra living expenses that might come up if you're displaced from your home (e.g., transportation, hotel costs).

Some companies might provide additional coverage that you can add to your core policy based on your needs. For example, maybe you have underground utility lines that you want to cover with your insurance policy. In that case, you can append underground utility line coverage on top of your standard policy.

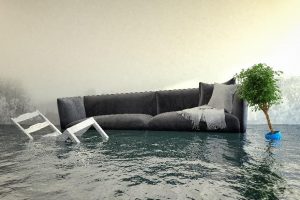

Do I also Need Flood Insurance?

If your location is at flood-risk, you should get flood insurance.

Where you live will inevitably influence the type of coverage you buy. If you live in an area with lots of extreme, wet weather, it's probably a good idea to get a separate flood insurance policy and protect against water damage. Your mortgage lender might need you to do so. Flood insurance is not included often with your home insurance policy. You usually have to buy a separate policy.

Bear in mind that flood insurance is different from hazard insurance. Hazard insurance appears to be a more general term that refers to the parts of your policy that defend your home against fire damage, theft, or damage from other natural disasters. The price of your hazard insurance varies based on where you live.

How much Home Insurance do I Need?

You want to ensure you're buying the right amount of coverage. Too much, and you might be getting scammed. Too little, and you might not have adequate coverage to keep your home covered.

Sequentially home insurance plans involve different levels of protection. The first level is the actual cash value. This covers the value of your home and its belongings, bearing in mind how the cost of these things will devalue over time.

The next level of coverage is replacement cost, which covers your home's actual cash value but doesn't take depreciation into account. This is considered a more robust type of coverage because it implies that your home will return to its original value once it's rebuilt.

Think about your financial situation and position in life. If you're purchasing a home that you plan on living in for years and years to come, you might want the ability to rebuild your home to its original value—which makes replacement value the level of coverage you want.